Revealed on December twenty seventh, 2024 by Bob Ciura

Spreadsheet knowledge up to date every day

Conservative retirement investing is all about creating passive revenue with high quality securities, held for the long-run.

At Positive Dividend, we concentrate on dividend paying shares (and carefully associated REITs, MLPs, and BDCs) to construct a rising and dependable passive revenue stream.

In the case of dependable dividend payers, there are not any higher shares than the Dividend Kings.

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

You may see the complete downloadable spreadsheet of all 54 Dividend Kings (together with vital monetary metrics reminiscent of dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink under:

Conservative retirement revenue investing prioritizes dividend longevity, and dividend security.

The very best focus of the Dividend Kings listing come from the Shopper Staples, Industrials, and Utilities sectors. These are the most effective market sectors for buyers on the lookout for conservative retirement revenue.

This text will listing the ten highest-yielding Dividend Kings, from the Shopper Staples, Industrials, and Utilities sectors.

The ten conservative retirement revenue shares under have Dividend Threat Scores of A or B, indicating robust dividend security.

The ten shares are ranked by dividend yield, from lowest to highest.

The shares are ranked by dividend yield, from lowest to highest.

Desk of Contents

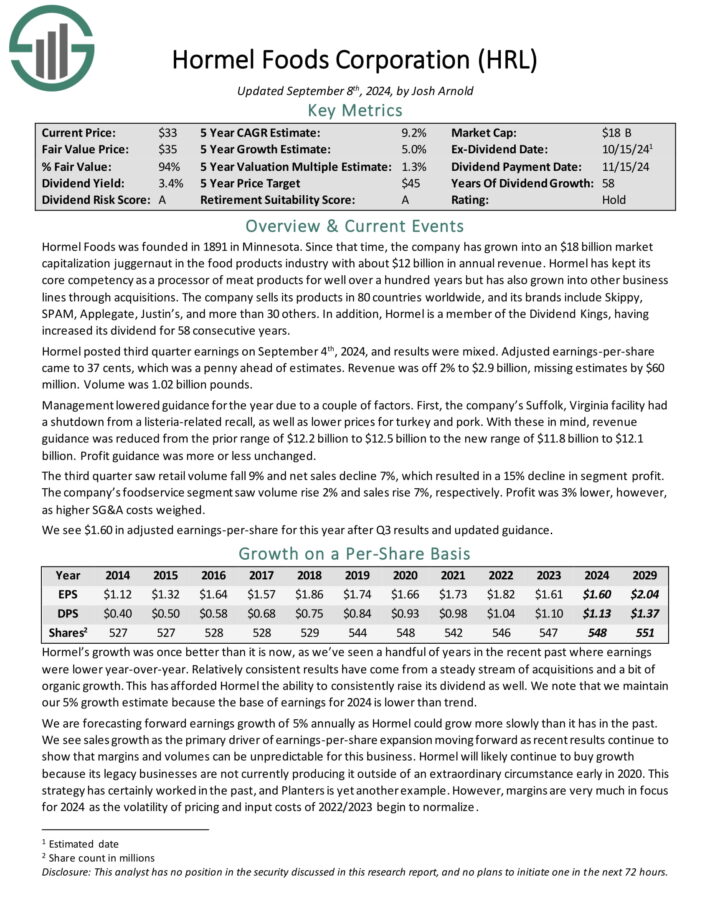

Conservative Retirement Revenue Inventory: Hormel Meals (HRL)

Hormel Meals is a juggernaut within the meals merchandise trade with almost $10 billion in annual income. It has a big portfolio of category-leading manufacturers. Just some of its high manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

It has additionally pursued acquisitions to drive development. For instance, in 2021, Hormel acquired the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s development.

Supply: Investor Presentation

Hormel Meals Company reported robust Q3 fiscal 2024 outcomes, with internet gross sales of $2.9 billion and adjusted working revenue of $267 million, exceeding expectations.

Key drivers included robust performances in retail manufacturers and worldwide markets, supported by ongoing enhancements from the corporate’s modernization initiatives.

The corporate posted diluted earnings per share of $0.32 ($0.37 adjusted) and a money movement from operations of $218 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on Hormel (preview of web page 1 of three proven under):

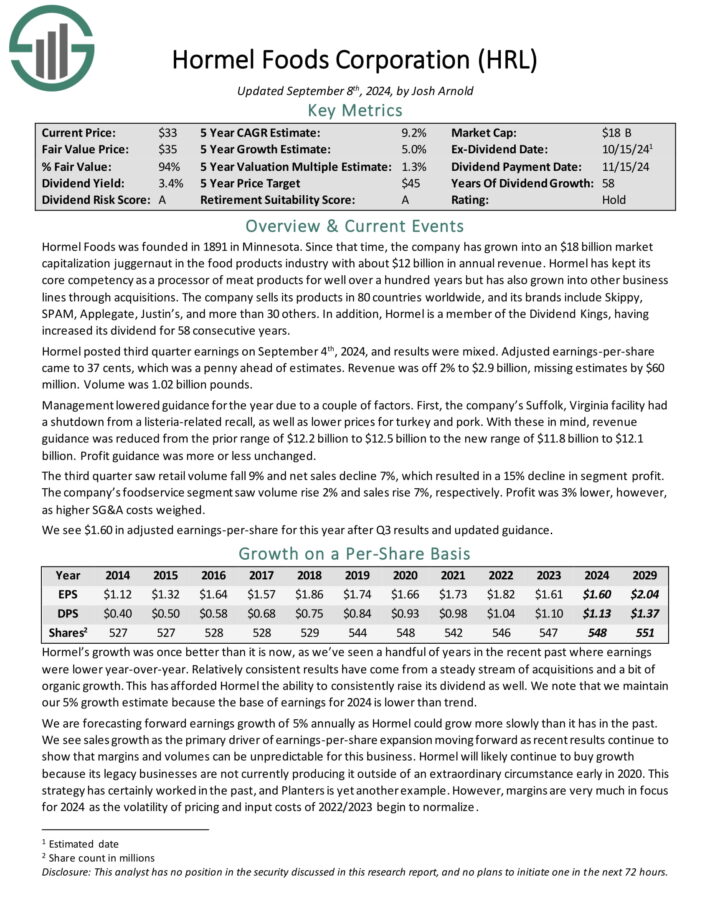

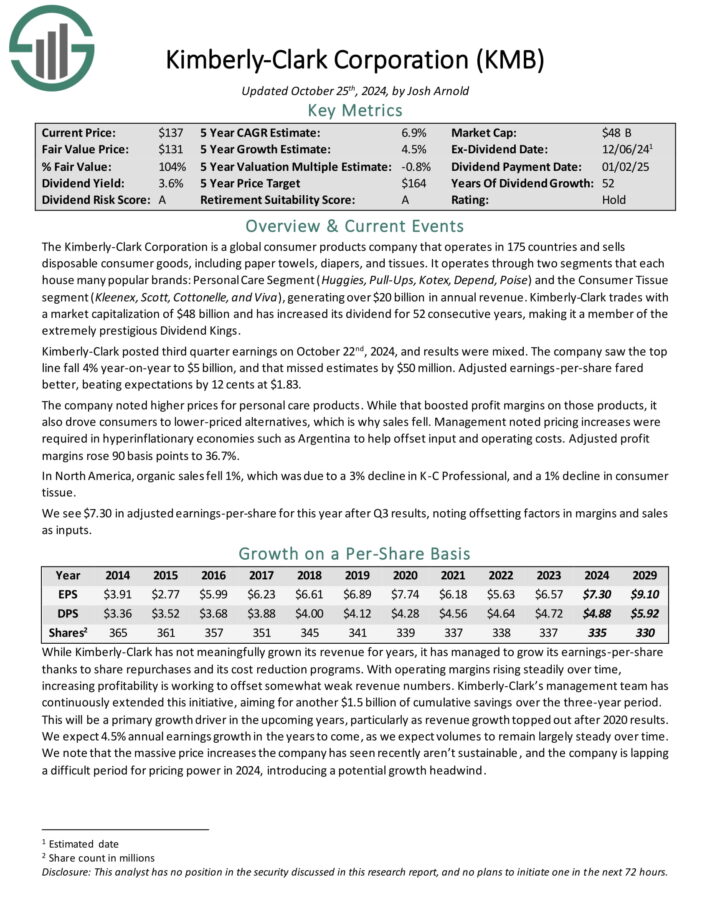

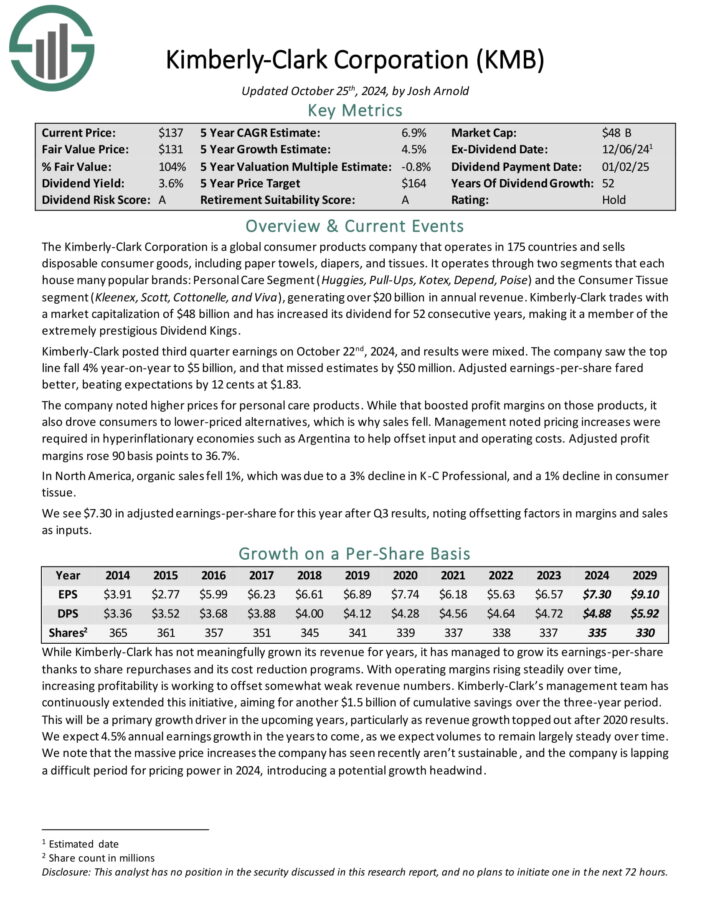

Conservative Retirement Revenue Inventory: Kimberly-Clark (KMB)

Kimberly-Clark is a worldwide shopper merchandise firm that operates in 175 nations and sells disposable shopper items, together with paper towels, diapers, and tissues.

It operates segments that every home many standard manufacturers: the Private Care Phase (Huggies, Pull-Ups, Kotex, Rely, Poise), the Shopper Tissue section (Kleenex, Scott, Cottonelle, and Viva), and knowledgeable section. In all, KMB generates ~$21 billion in annual income.

Supply: Investor Presentation

Kimberly-Clark posted third quarter earnings on October twenty second, 2024, and outcomes had been blended. The corporate noticed the highest line fall 4% year-on-year to $5 billion, and that missed estimates by $50 million. Adjusted earnings-per-share fared higher, beating expectations by 12 cents at $1.83.

The corporate famous larger costs for private care merchandise. Whereas that boosted revenue margins on these merchandise, it additionally drove customers to lower-priced alternate options, which is why gross sales fell.

Administration famous pricing will increase had been required in hyper-inflationary economies reminiscent of Argentina to assist offset enter and working prices. Adjusted revenue margins rose 90 foundation factors to 36.7%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Kimberly-Clark (preview of web page 1 of three proven under):

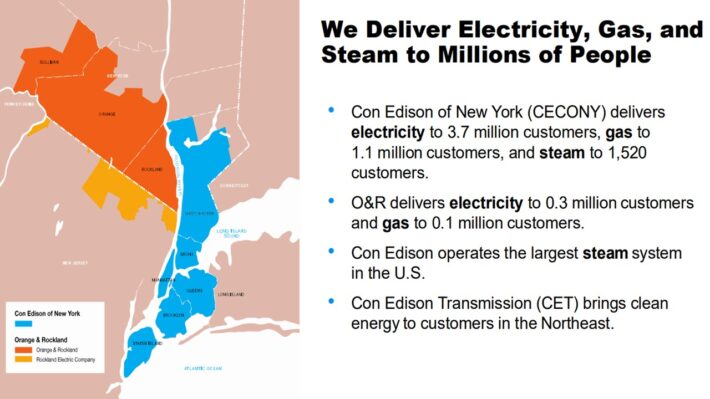

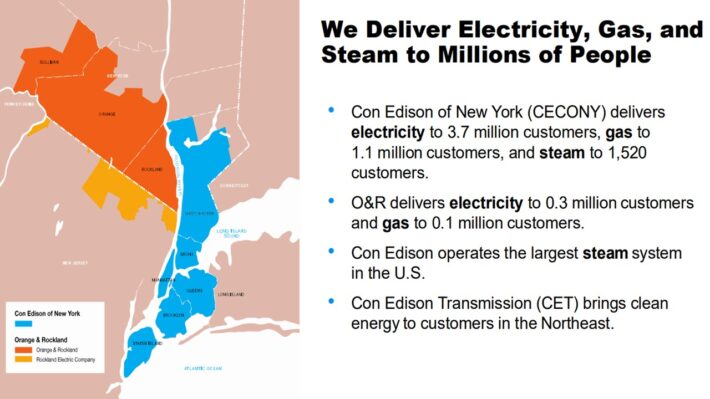

Conservative Retirement Revenue Inventory: Consolidated Edison (ED)

Consolidated Edison is a large-cap utility inventory. The corporate generates almost $15 billion in annual income and has a market capitalization of roughly $36 billion.

The corporate serves 3.7 million electrical clients, and one other 1.1 million gasoline clients, in New York.

Supply: Investor Presentation

It operates electrical, gasoline, and steam transmission companies, with a steam system that’s the largest within the U.S.

On November seventh, 2024, Consolidated Edison reported third quarter outcomes. For the quarter, income improved 5.7% to $4.1 billion, which topped estimates by $26 million.

Adjusted earnings of $583 million, or $1.68 per share, in comparison with adjusted earnings of $561 million, or $1.62 per share, within the earlier yr. Adjusted earnings-per-share had been $0.10 greater than anticipated.

As with prior intervals, larger charge bases for gasoline and electrical clients had been the first contributors to ends in the CECONY enterprise, which accounts for the overwhelming majority of the corporate’s property.

Common charge base balances are nonetheless anticipated to develop by 6.4% yearly for the 2024 to 2028 interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on Consolidated Edison (preview of web page 1 of three proven under):

Conservative Retirement Revenue Inventory: Kenvue Inc. (KVUE)

Kenvue is a shopper staples firm with three segments: Self Care, Pores and skin Well being and Magnificence, and Important Well being. Self Care’s product portfolio contains cough, chilly, allergy, smoking cessation, and ache care merchandise amongst others.

Pores and skin Well being and Magnificence holds merchandise reminiscent of face, physique, hair, and solar care. Important Well being incorporates merchandise for girls’s well being, wound care, oral care, and child care.

Properly-known manufacturers in Kenvue’s product line up embody Tylenol, Listerine, Band-Help, Neutrogena, Nicorette, and Zyrtec. These companies contributed roughly 17% of Johnson & Johnson’s annual income.

On November seventh, 2024, Kenvue reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. Income decreased 0.5% to $3.9 billion, which was $20 million lower than anticipated.

Adjusted earnings-per-share of $0.28 in contrast unfavorably to $0.31 final yr, however this was $0.01 above estimates.

Natural gross sales had been up 0.9% for the quarter, which follows a 3.6% enchancment final yr. For the quarter, pricing and blend profit of two.5% was offset by a 1.6% decline in quantity.

As soon as once more, quantity development in Important Well being was offset by weak point in Pores and skin Well being and Magnificence and Self Care. Gross revenue margin expanded 100 foundation factors to 58.5%.

Click on right here to obtain our most up-to-date Positive Evaluation report on KVUE (preview of web page 1 of three proven under):

Conservative Retirement Revenue Inventory: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the biggest publicly traded farmland product firm in the US. Archer-Daniels-Midland’s companies embody processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter outcomes for Fiscal 12 months (FY) 2024 on November 18th, 2024. The corporate reported adjusted internet earnings of $530 million and adjusted EPS of $1.09, each down from the prior yr as a consequence of a $461 million non-cash cost associated to its Wilmar fairness funding.

Consolidated money flows year-to-date reached $2.34 billion, reflecting robust operations regardless of market challenges.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADM (preview of web page 1 of three proven under):

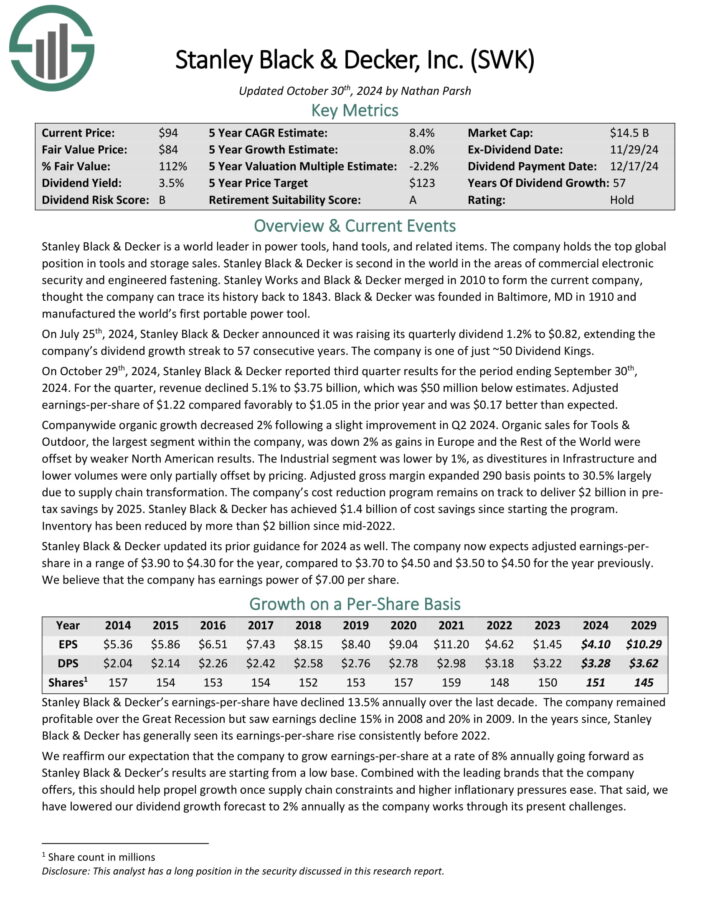

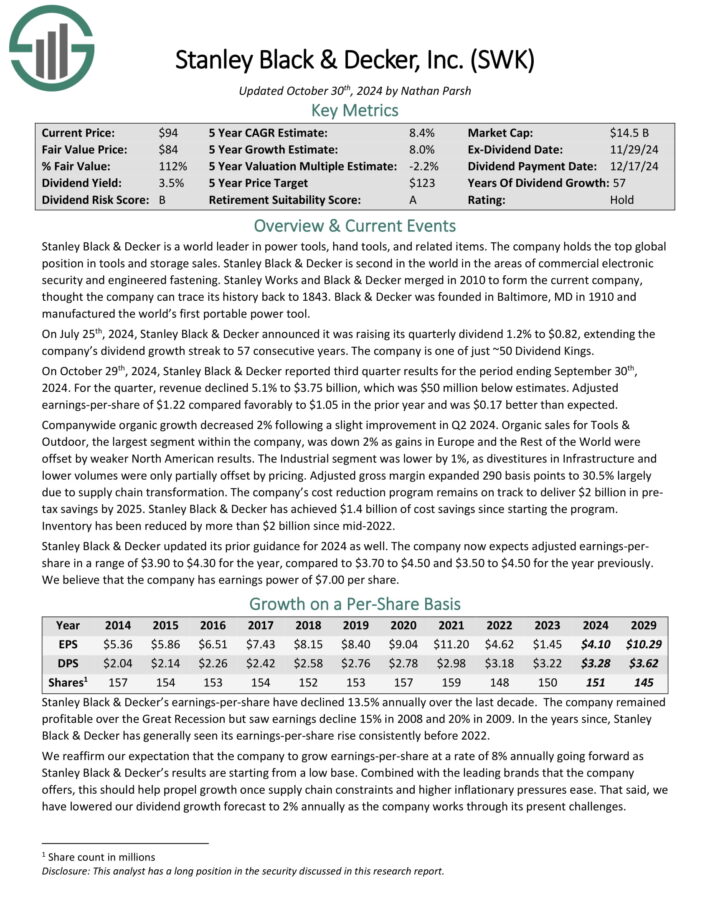

Conservative Retirement Revenue Inventory: Stanley Black & Decker (SWK)

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest international place in instruments and storage gross sales.

It’s second on this planet within the areas of business digital safety and engineered fastening. The corporate consists of three segments: instruments & out of doors, and industrial.

Supply: Investor Presentation

On October twenty ninth, 2024, Stanley Black & Decker reported third quarter outcomes. For the quarter, income declined 5.1% to $3.75 billion, which was $50 million under estimates. Adjusted earnings-per-share of $1.22 in contrast favorably to $1.05 within the prior yr and was $0.17 higher than anticipated.

Firm-wide natural development decreased 2% following a slight enchancment in Q2 2024. Natural gross sales for Instruments & Out of doors, the biggest section inside the firm, was down 2% as good points in Europe and the Remainder of the World had been offset by weaker North American outcomes.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWK (preview of web page 1 of three proven under):

Conservative Retirement Revenue Inventory: Black Hills Corp. (BKH)

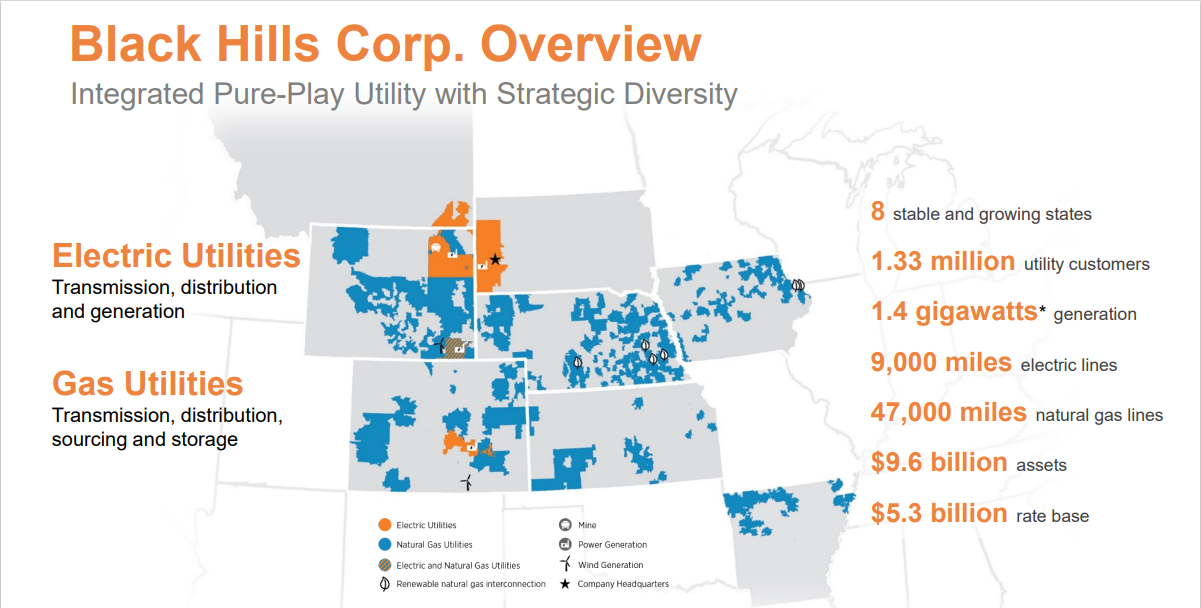

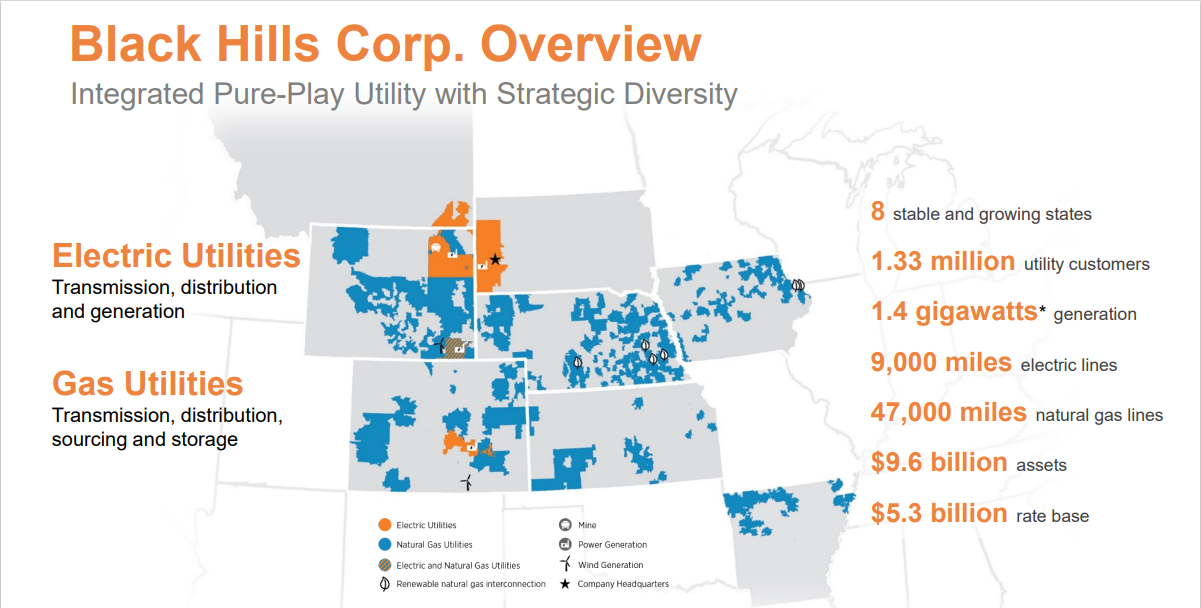

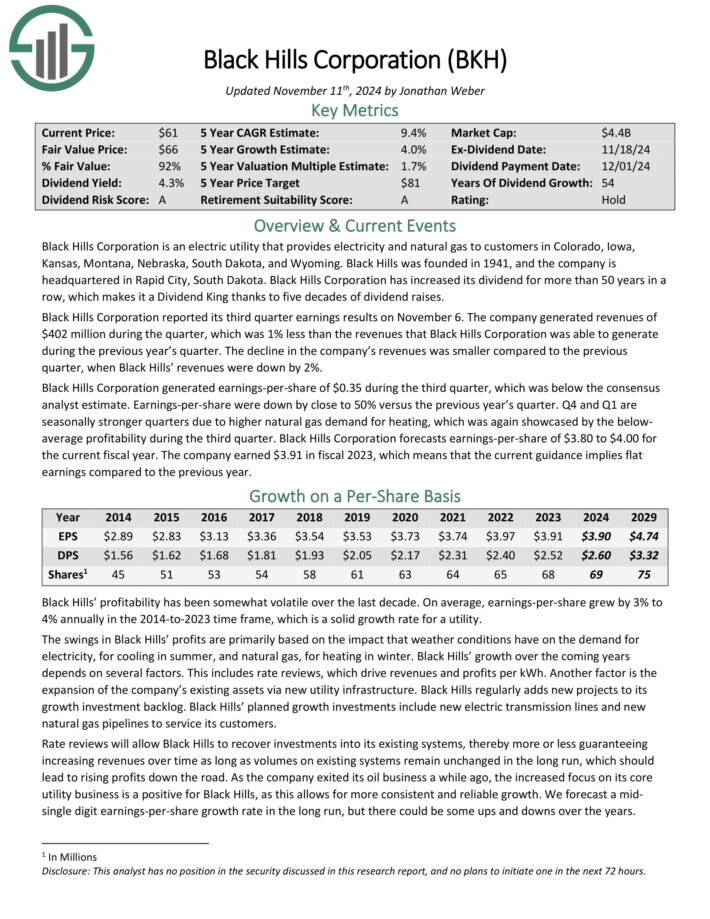

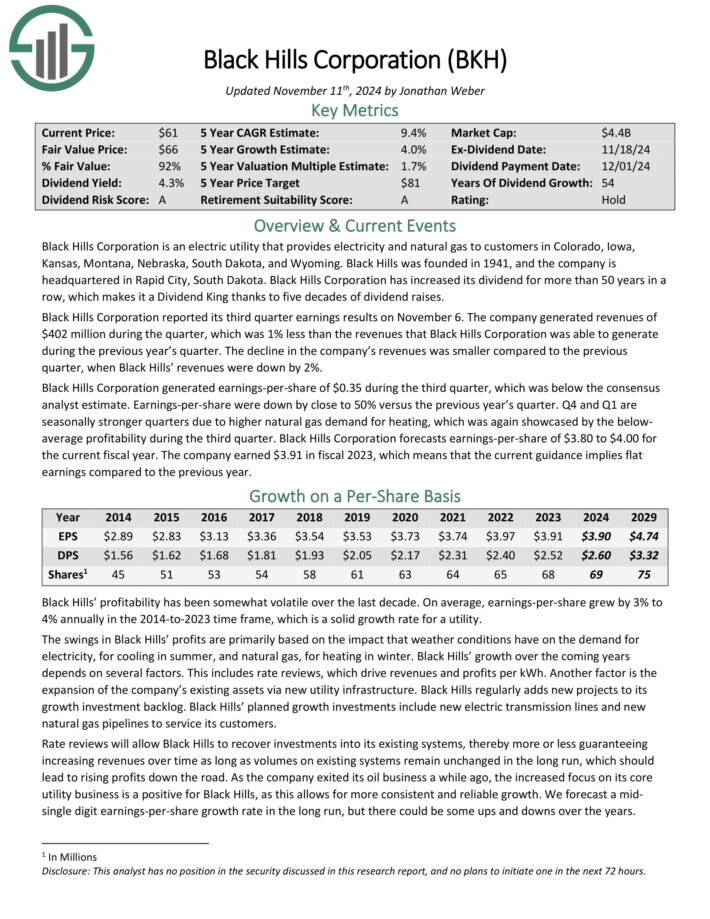

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to clients in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.33 million utility clients in eight states. Its pure gasoline property embody 47,000 miles of pure gasoline traces. Individually, it has ~9,000 miles of electrical traces and 1.4 gigawatts of electrical technology capability.

Supply: Investor Presentation

Black Hills Company reported its third quarter earnings outcomes on November 6. The corporate generated revenues of $402 million through the quarter, down 1% year-over-year.

Black Hills Company generated earnings-per-share of $0.35 through the third quarter, which was under the consensus analyst estimate. Earnings-per-share had been down by near 50% versus the earlier yr’s quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on BKH (preview of web page 1 of three proven under):

Conservative Retirement Revenue Inventory: Northwest Pure Holding (NWN)

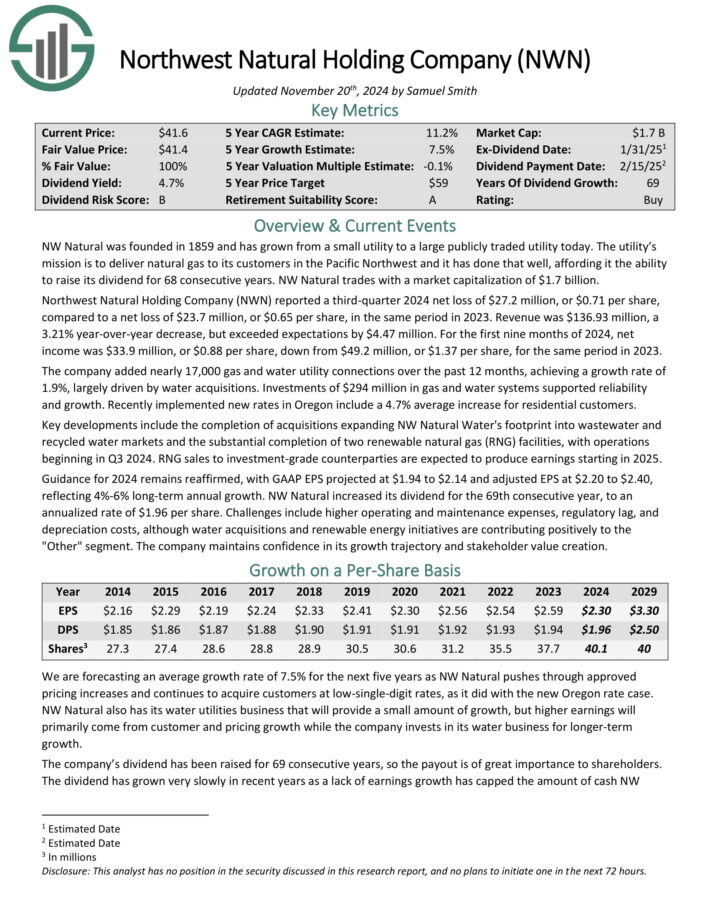

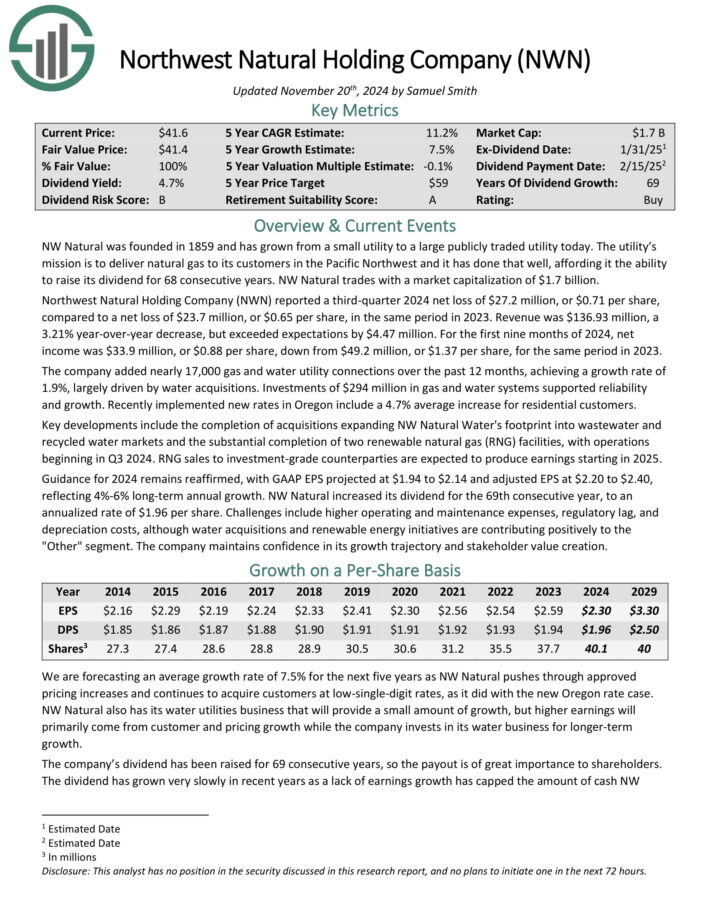

Northwest Pure was based over 160 years in the past as a pure gasoline utility in Portland, Oregon.

It has grown from a really small, native utility that offered gasoline service to a handful of consumers to a regional utility with pursuits that now embody water and wastewater, which had been bought in latest acquisitions.

The corporate’s places served are proven within the picture under.

Supply: Investor Presentation

Northwest offers gasoline service to 2.5 million clients in ~140 communities in Oregon and Washington, serving greater than 795,000 connections. It additionally owns and operates ~35 billion cubic toes of underground gasoline storage capability.

Northwest Pure Holding Firm reported a third-quarter 2024 internet lack of $27.2 million, or $0.71 per share, in comparison with a internet lack of $23.7 million, or $0.65 per share, in the identical interval in 2023. Income was $136.93 million, a 3.21% year-over-year lower, however exceeded expectations by $4.47 million.

For the primary 9 months of 2024, internet revenue was $33.9 million, or $0.88 per share, down from $49.2 million, or $1.37 per share, for a similar interval in 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven under):

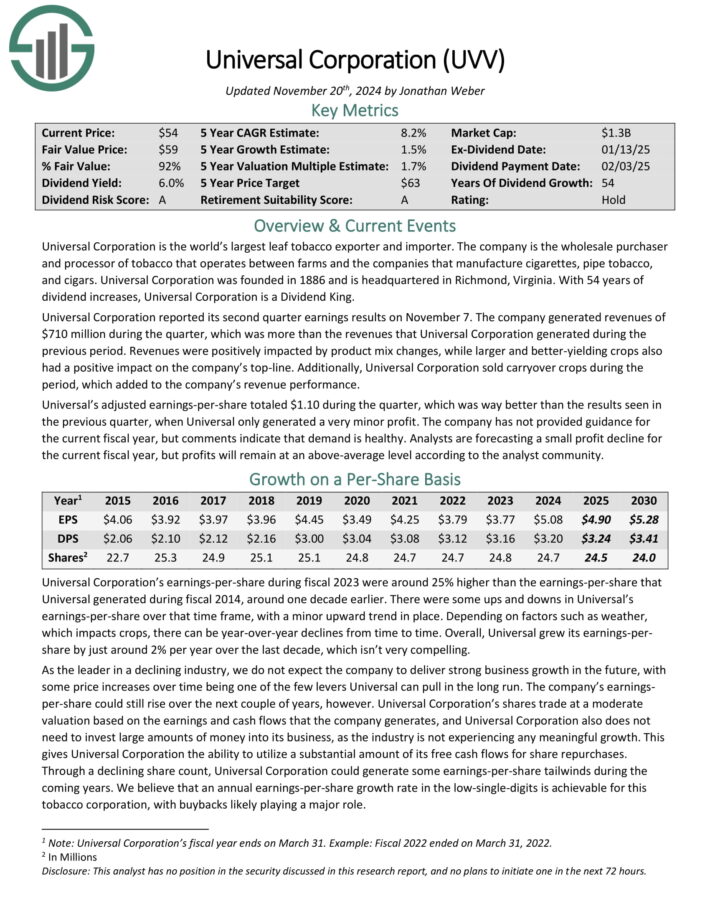

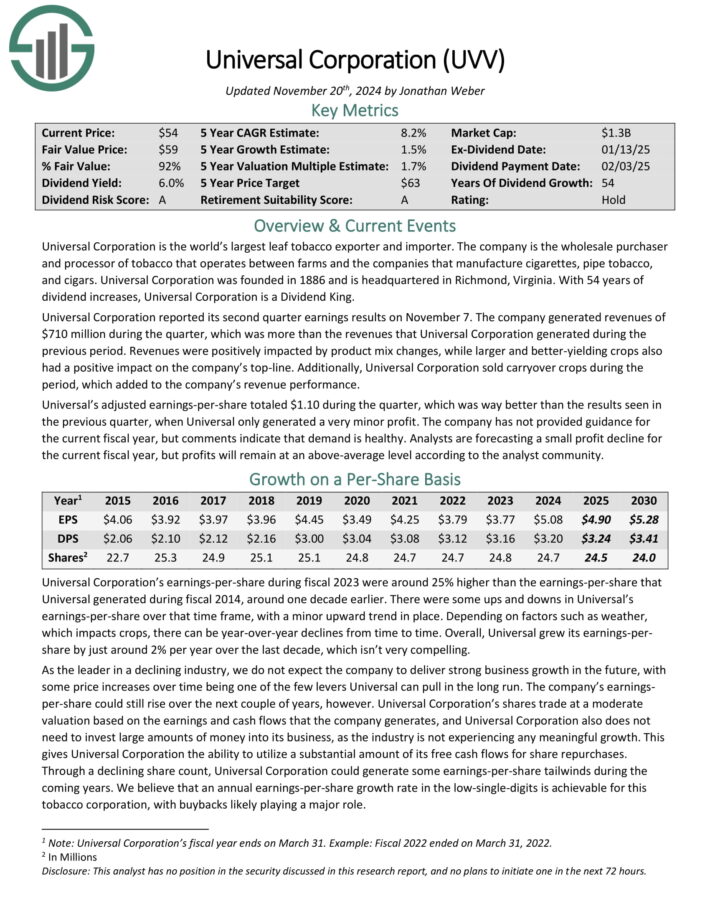

Conservative Retirement Revenue Inventory: Common Company (UVV)

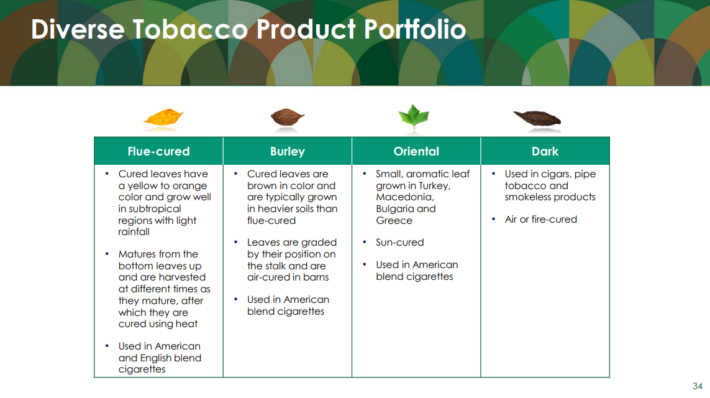

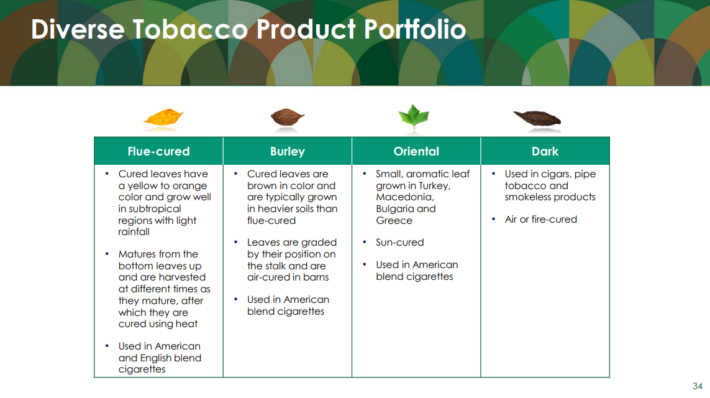

Common Company is a market chief in supplying leaf tobacco and different plant-based inputs to shopper product producers.

The Tobacco Operations section buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless merchandise.

Common buys tobacco from its suppliers, processes it, and sells it to giant tobacco firms within the US and internationally.

Supply: Investor Presentation

The Ingredient Operations deal primarily with greens and fruits however is considerably smaller than the tobacco operations. Common has been rising this enterprise via acquisitions beginning in 2020.

Common Company reported its second quarter earnings outcomes on November 7. The corporate generated revenues of $710 million through the quarter.

Moreover, Common Company bought carryover crops through the interval, which added to the corporate’s income efficiency.

Click on right here to obtain our most up-to-date Positive Evaluation report on Common (preview of web page 1 of three proven under):

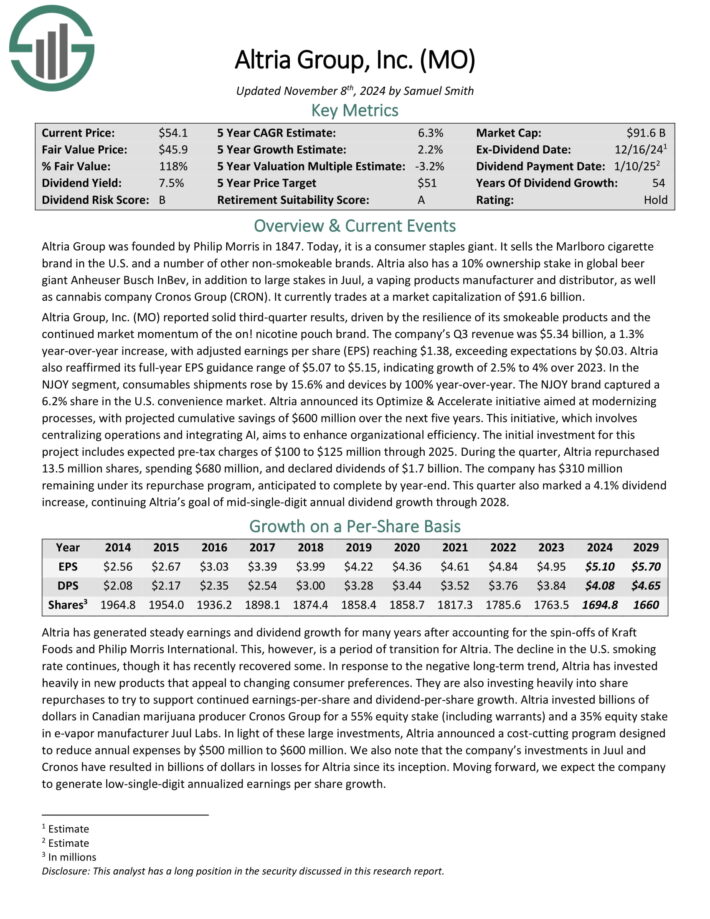

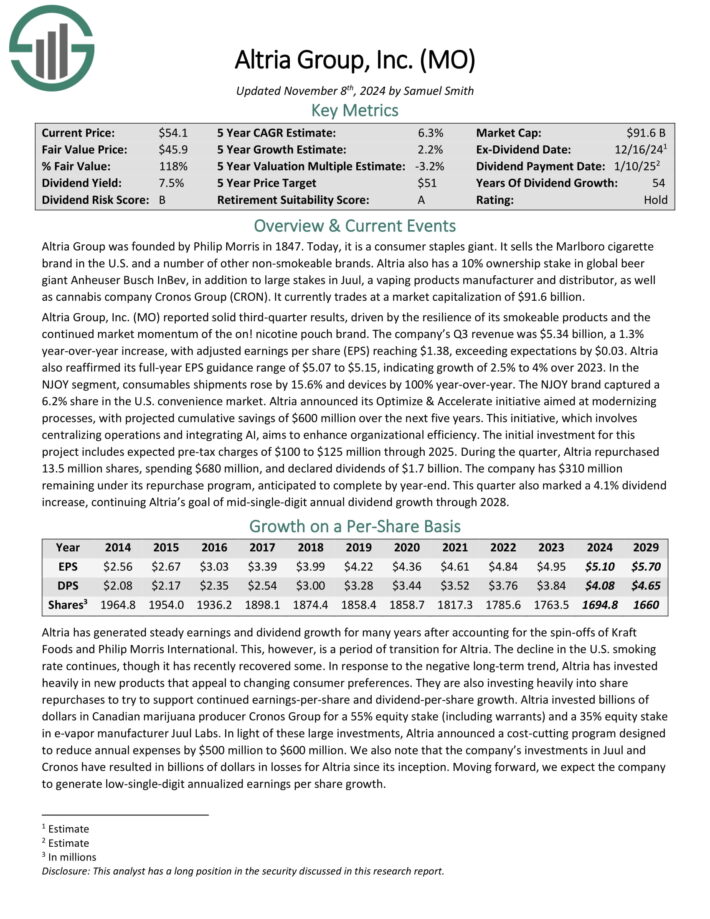

Conservative Retirement Revenue Inventory: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra below a wide range of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the hashish firm Cronos Group (CRON).

Altria reported stable third-quarter outcomes, pushed by the resilience of its smokeable merchandise and the continued market momentum of the on! nicotine pouch model.

Supply: Investor Presentation

The corporate’s Q3 income was $5.34 billion, a 1.3% year-over-year improve, with adjusted earnings per share (EPS) reaching $1.38, exceeding expectations by $0.03.

Altria additionally reaffirmed its full-year EPS steering vary of $5.07 to $5.15, indicating development of two.5% to 4% over 2023.

Through the quarter, Altria repurchased 13.5 million shares, spending $680 million, and declared dividends of $1.7 billion. The corporate has $310 million remaining below its repurchase program, anticipated to finish by year-end.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven under):

Last Ideas

Screening to seek out the most effective Dividend Kings just isn’t the one method to discover high-quality dividend development inventory concepts.

Positive Dividend maintains related databases on the next helpful universes of shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].