Four years after Tacoma was crowned the hottest housing market in the U.S., the city has earned a more dubious distinction — the highest rate of financially strapped homeowners in any large Washington city.

Homeowners in T-Town are more likely to be “house poor” and living beyond their means than those in any other larger city in the state, according to a new report by Chamber of Commerce, a resource organization for small businesses.

Nationally, the city ranks in the top 30 of the 170 most populous cities for homeowners spending over 30% of their income on housing costs. Seattle ranks a distant 108. Spokane and Vancouver rank even lower.

This is despite the fact that Tacoma has less-expensive homes and lower housing costs than Seattle. Proportionally, the share of income spent on housing costs in Tacoma is 5% greater than in Seattle.

In fact, Tacoma is the only large Washington city where the number of cost-burdened homeowners outnumber the share of homeowners living well within their budgets. In Seattle, for every “house poor” homeowner, there are nearly two homeowners spending less than 20% of their income on housing costs.

Experts say Tacoma’s large share of financially stressed homeowners speaks to a national trend that’s seen growing demand for homes in affordable cities within the larger, expensive metro areas driving up prices.

“We have a lot of people who come down from Seattle, and we have a lot of people coming from California looking to live in an affordable place with amenities close to Seattle,” said Tacoma native Dave Jones, owner of a Windermere Abode office in the city.

That relative affordability may be encouraging first-time homebuyers to take on more costs than they can afford to lock in a good price for a home with good local amenities, Redfin economist Taylor Marr said.

“If your income grows you might start off cost-burdened at 40% but over the next five or 10 years you’re in that home, that can trend downward,” Marr said.

The trend of rising prices in the last affordable corners of the Seattle metro area began before the pandemic, and has accelerated since.

Redfin and Zillow show a Seattle home stays on the market at least a day longer than a Tacoma home. Housing prices in Tacoma rose 64% over five years to the first quarter of 2023. In that time Seattle prices rose 45%, according to the U.S. Federal Housing Finance Agency.

Zillow economist Jeff Zucker believes this growing cost burden also extends to renters and people entirely priced out of homeownership.

“It’s a new tough reality for all residents in the region,” he said. “There are now fewer affordable places to look for housing, and housing is getting more unaffordable everywhere here.”

Tacoma residents’ growing cost burden has a lot to do with wages failing to keep up with galloping home prices, Jones said.

The city’s top employers are the military, health care companies, the government and public schools. The Seattle area, meanwhile, is home to 10 Fortune 500 companies including Amazon, Costco, Microsoft and Starbucks.

“So how are we supposed to support and sustain people who live here with … the median home price nearly doubling in five years?” Jones said.

The ripple effects of the West Coast tech boom also reached Spokane.

Over the past five years, as migration from the coast to the inland West grew, Spokane’s housing prices rose 83%, outpacing the two large Puget Sound cities.

This trend somewhat cooled recently after accelerating during the pandemic, and it did not lead to the financial stress Tacoma homeowners are burdened with.

On median income alone, Tacoma homeowners still earn more than their counterparts in Spokane or Vancouver, Wash. But with lower housing costs, these other two cities are still more affordable.

Residents in Spokane were also able to stave off some of the growing housing market pressure as the city has a fairly elastic supply of housing, Zucker said. “There’s a lot of room to build and respond to housing demand by just building enough homes for those who want them, which has helped in the long run.”

Supply aside, demographics play a key role in determining the share of cost-burdened homeowners in these cities.

“There’s a lot of young households that have moved in the Seattle and Tacoma area,” Marr said. While Spokane and Vancouver have been growing, too, Marr said the home-owning population in these areas still skews older.

“Older people who may have lower incomes, or a fixed income even, … have locked in housing costs a long time ago and have lower housing costs in general,” the Redfin economist continued.

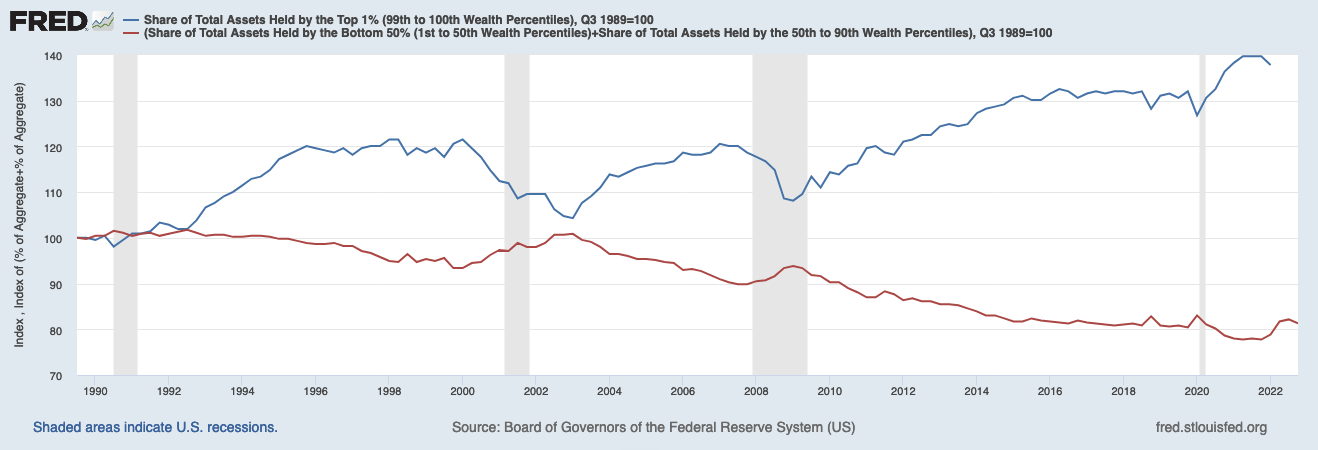

The burdens of housing costs are also undeniably connected to race and access to generational wealth.

“How many Black or brown families, historically kept out or marginalized from housing, are in areas like Spokane or Vancouver?” said Jones, a leading Black Realtor in the state.

Like other U.S. cities, Tacoma saw banks refuse to extend credit to Black and other racial and ethnic minority neighborhoods that were also denied other basic services, with the north of the city more affluent than the south and east.

These practices helped segregate cities, and prevent communities of color from living in high-opportunity neighborhoods and accumulating intergenerational wealth through homeownership, observed a 2021 housing disparities report by the city.

From 1990 to 2020, Black homeownership dropped sharply, the report’s authors said, finding that lending inequities continue today.

Over 65% of white mortgage applicants succeeded in securing home loans, compared with 51% of Black and 54% of Hispanic applicants, according to a 2020 mortgage analysis for Tacoma. Debt-to-income ratio and credit history were the primary reasons cited to deny their mortgage applications.

These are the same communities that are now the most cost-burdened, where gentrification hasn’t pushed them out of the city. “They are having the biggest trouble because of the employment opportunities — then layer on discrimination in lending,” Jones said.

Collected in 2020, the data doesn’t cover the recent shifts in home prices and inflation.

“Everything was much more affordable two years ago,” Zucker said. “So it would be interesting to ask, essentially the same question but only among people who bought homes in the last year or two in Tacoma.”

To its credit, Jones said, the city of Tacoma has been working to address these inequities.

“We’re trying our best but some of these issues are so systemic and rooted in our historic racist practices, it’s hard to undo in the short term as housing prices climb so fast.,” he said. “I strongly believe if you were born and raised in Tacoma, and went to the city public schools here, you should be able to buy a home and live here.”